In this feature, she shares about her time as an intern at Visa through the PolyFinTech100 initiative, as well as how the experience has helped her in her journey.

What prompted/ attracted you to take up an internship at Visa through the PolyFinTech100 programme?

The topic on FinTech was raised during classes and discussions in polytechnic. It sparked my interest and I became curious to find out more. When I found out about the internship opportunity at Visa, I was ecstatic. Visa is a well-known company and the job scope sounded exciting. It was the perfect opportunity for me to learn more about the FinTech industry through an internship at Visa.

As interns, we had opportunities to support major projects and events with Visa’s largest clients and strategic partners across AP.

Tell us more about the FinTech internship at Visa. How was the interview done?

During my internship, I was working at Visa’s Innovation and Strategic Partnerships (I&SP) department. I was able to interact with different stakeholders and gain experience relating to innovation. My key responsibilities included creating strategic partnerships with Visa’s stakeholders and supporting FinTech-related events and ventures. I also provided timely reporting to internal senior stakeholders and planning events. Some of the notable events were the Singapore Fintech Festival 2017, Visa’s Everywhere Initiative Thailand and Fintech Finals 2018.

I also worked closely for Visa Ventures by providing market research for the Asia Pacific region. This allowed me to gain an understanding of the Venture Capital (VC) world.

The selection process included a face-to-face interview conducted at the Visa office. The interviewers were very friendly and made the interview session enjoyable. During the interview, I gained a clearer understanding of the department’s operations and team culture. My interviewer even went the extra mile to bring me on a tour around the innovation centre, which I gladly accepted.

What have you learnt from the internship?

I have learnt a wide range of skills and knowledge by getting exposure to different areas of the business. The most important skill I learnt is to be able to work well under pressure. There were periods where events got scheduled consecutively, which caused a sudden surge in tasks. For example, I was involved in both the Singapore Fintech Festival as well as the Visa Ready Forum, which happened concurrently on the same day. Preparations before the events were done at the same time. The experience taught me how to prioritise my workload and use my time more efficiently under pressure.

What skillsets & characteristics do you think are important for students who want to take up a future career in FinTech?

Besides technical skills such as programming, the important characteristics one should have is a positive attitude and to be self-motivated. As the tech scene is constantly changing, we must consistently put in extra effort to keep ourselves updated with the newest tech trends.

Congratulations on your recent award of the Smart Nation Scholarship from GovTech. Can you please tell us more about it, and what prompted you to apply for it?

Thank you! The Smart Nation Scholarship is a scholarship which aims to develop and nurture individuals with strong interests in technology within public service. It is offered by the Cyber Security Agency of Singapore (CSA), Government Technology Agency (GovTech), and Infocomm Media Development Authority (IMDA).

Since I was young, I have always dreamed of creating tech products to bring convenience to other people’s lives. When I was learning more about the different agencies, I found out that GovTech focuses on building technology for Singaporeans, which was very similar to my personal goal. With GovTech, I will be able to work towards creating better standards of living for Singaporeans and contribute to driving Singapore towards a Smart Nation with unyielding support. This realization was the defining factor that motivated me to apply for the scholarship.

Looking back, how did the PolyFinTech100 internship at Visa lay the groundwork for you to chart your future and eventually ace your scholarship application with Smart Nation?

My internship with Visa allowed me to witness the positive impact innovation can bring first-hand. During my internship, I gained soft skills and industry knowledge, which allowed me to become a better version of myself for my future endeavours. The experience has allowed me to reaffirm my personal goal of creating products for Singaporeans in the future.

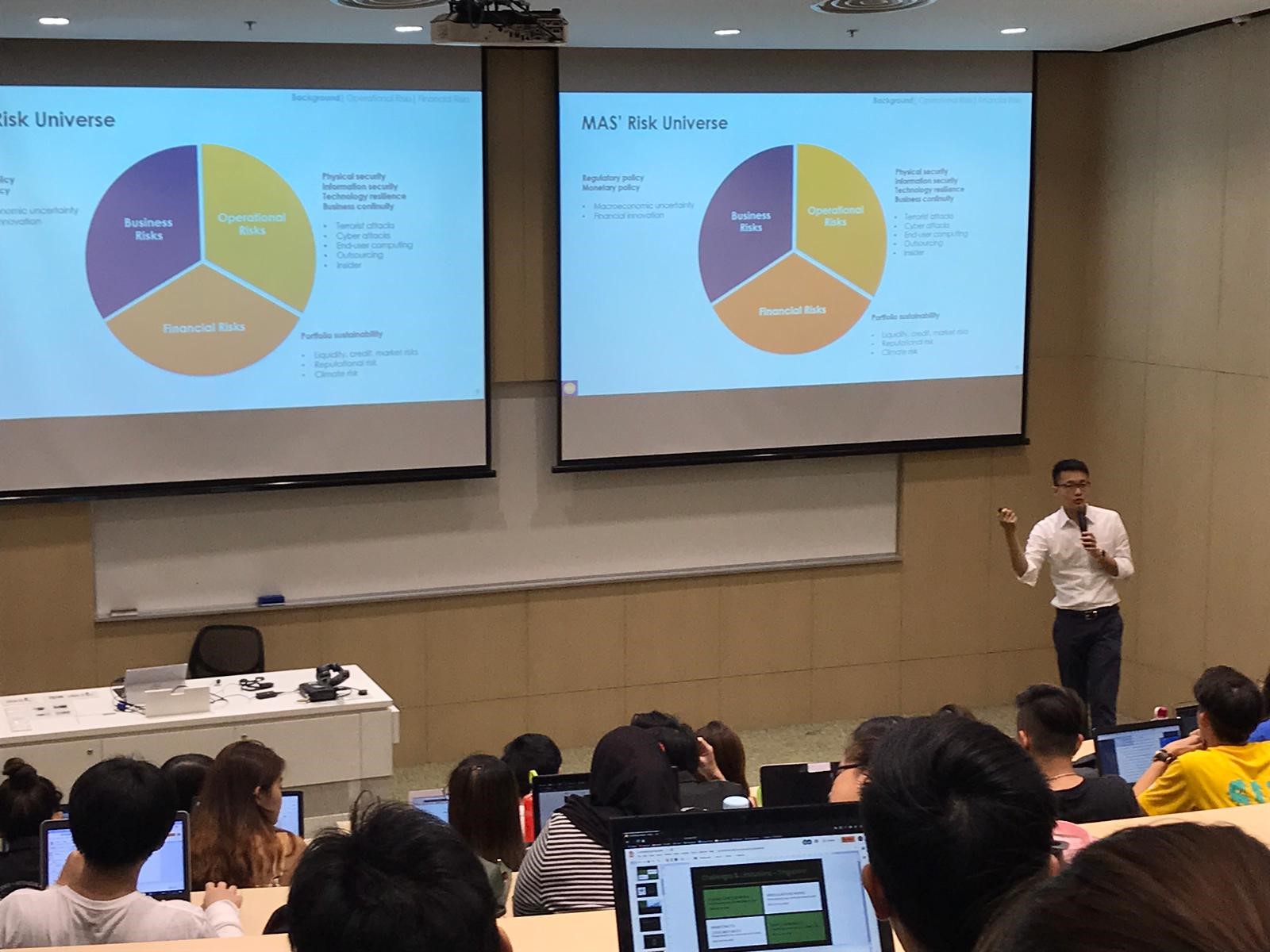

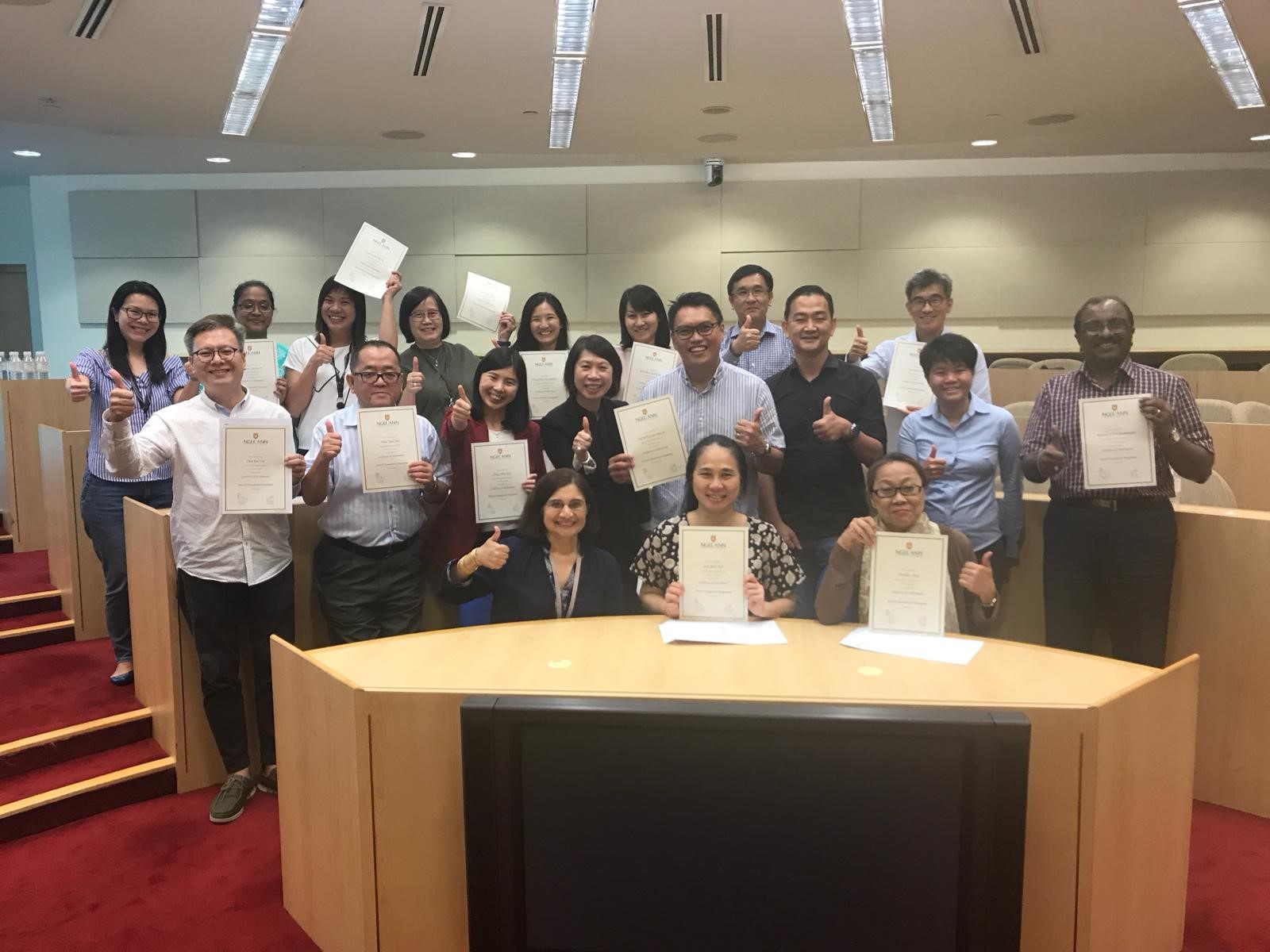

On 8 Nov 2019, we held an enriching sharing session by PolyFinTech 100 mentor Ms Soh Siew Choo, Managing Director and Head of Consumer Banking & Big Data Analytics Technology, DBS Bank on the Digital Transformation of Financial Services, held at Temasek Polytechnic, School of Informatics & IT.

The session provided an insightful understanding into the fast sweeping digital transformation taking place in the financial industry. Ms Soh also emphasized on the importance for students to be avid learners in taking on new learning challenges to prepare themselves for the digital economy ahead.

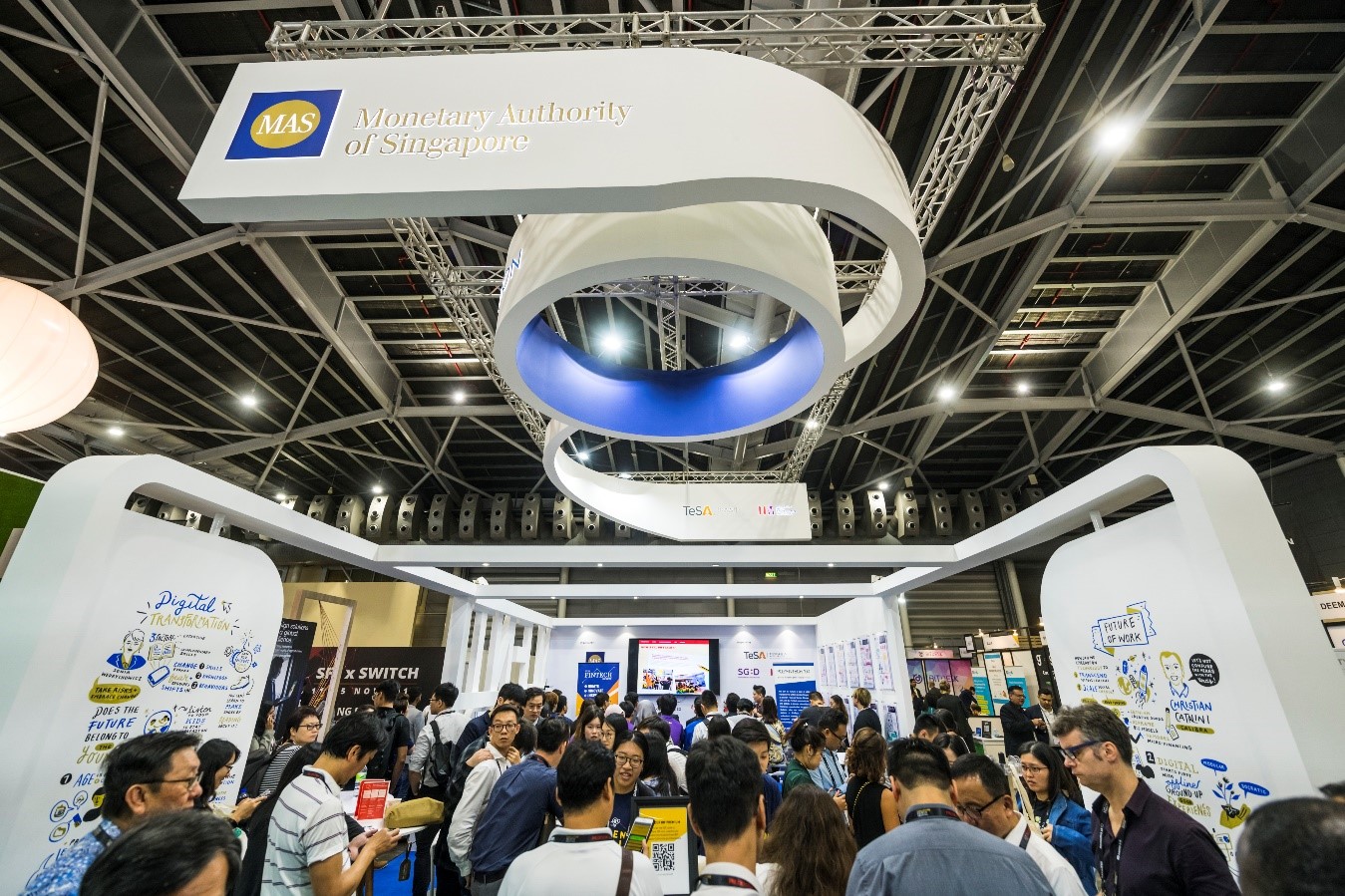

PolyFinTech 100, together with government agencies and Institutes of Higher Learning (IHL), got together at the Talent Pavilion booth at the Singapore FinTech Festival, serving as a central venue for professionals, job-seekers, employers and students looking to be part of the FinTech ecosystem.

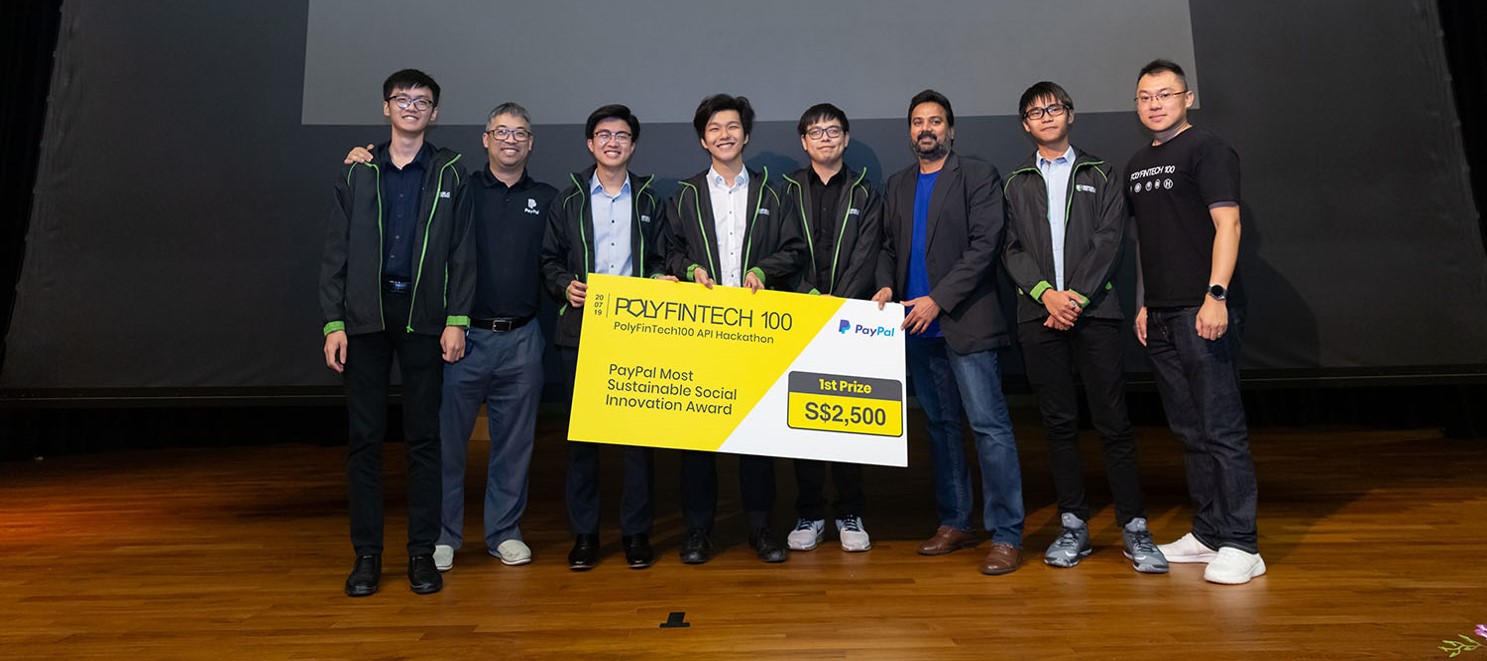

Congratulations to the winning team! Watch their video here.

Over 5 days, the delegates visited the FinTech festival, immersed in industry sharing with industry practitioners in FinTech, learnt about applications of Design Thinking in financial services and visited innovation labs.

The participants revealed they gained relevant knowledge through this programme, hoping to apply what they had learnt back in their home countries.

Token Economy Association and Tribe Accelerator Best Use Case for Blockchain Award - Champion: Team Excalibur (SP)

See this video for exciting highlights from the event!

Polytechnic News Links

Republic Polytechnic: Facebook, LinkedIn

Singapore Polytechnic: School of Business News, School of Computing News

The event kicked off with an opening presentation “The Future is Now”, by Ms Namrata Jolly, Former Regional Head of Digital Experience and Engagement at Citibank & Former Head of Customer & Digital at Prudential. This was followed by a sharing by Mr Choy Siew Kai, Former Managing Director, GIC Private Limited and Fellow at Stanford University Distinguished Careers Institute, on the topic “Will AI replace or augment Finance jobs in the future?”

The third session was helmed by Mr Shameek Kundu, Chief Data Officer, Standard Chartered Bank, who spoke on the topic “Data as the engine of growth for the economy – How are banks leveraging on data?” In the closing session, Dr Ernie Teo, Chief Technology Officer, JEDTrade, spoke on the topic “Is Blockchain a hype? What are the applications of Blockchain today?”

The PolyFintech 100 team looks forward to organising more events to connect our mentors and students further. Watch this space!

The PRUFintegrate competition was first introduced to me by my lecturer. With the problem statements that were given to me, I had decided on a problem statement that was the most relatable and closest to me. After deciding on the topic, I did a fair amount of research and completed my topic within the day and I submitted the proposal to my lecturer.

When I first heard the news that I had managed to clinch the gold prize, I was extremely shocked and ecstatic. This win gave me the opportunity to present at the Singapore FinTech Festival in Nov 2018. This presentation gave me a glimpse into the corporate world and its inner workings. The experience was incredibly fulfilling.

I was privileged to be invited to a luncheon with the CEO of Prudential Singapore, which was a memorable event. I was able to converse with the top management of Prudential Singapore, and learn more about their thought process, as well as their world views. This opportunity provided me with numerous fresh insights which helped to widen my horizons.

I also had the opportunity to go on an exciting trip with Prudential staff members to the Innov8rs conference in Shanghai from 25 to 28 Jun 2019. It was a wonderful and enriching trip, in which I had met a lot of like-minded people in the field of innovation, and also made new friends while being immersed in a new culture. This experience taught me how to step out of my comfort zone, and pushed me to learn how to interact with people from various backgrounds, departments, nationalities and different walks of life. This trip had also equipped me with more knowledge, self-awareness and connections.

Congratulations once again to all the winners!

Click here for video highlights from the three-day event.

The winners for each award category are as follows:

Most Innovative DBS Solution Award: Billboard (Singapore Polytechnic)

OCBC Best Planned & Executed Award: iVestor (Temasek Polytechnic)

NETS Most Innovative Payment Award: PolyGen (Republic Polytechnic)

Open Category Award: D$ave (Temasek Polytechnic)

Best Pitch Award: Peer Funding Platform (Temasek Polytechnic)

PolyFinTech100 Award: UniPoints (Ngee Ann Polytechnic)

Congratulations to the winning teams!

See this video for exciting highlights from the event!

.jpeg)

Hailed as the first innovation lab crawl, a group of Ngee Ann Polytechnic (NP) students embarked on an exciting tour around Visa Innovation Centre's Asia Pacific headquarters. This initiative is part of a series of lab crawls and workshops that stemmed from the Memorandum of Understanding (MOU) inked with Singapore Fintech Association (SFA).

Towards the last leg of the tours, students are required to solve a business challenge faced by the companies they visited. Under the guidance of the PolyFinTech 100 mentors, they would then propose a solution for the companies.

Like its catchy tagline, Visa wowed us and the students with its sprawling office, which spans four levels and a cool interior. There was plenty of natural light (great for your Instagram feed by the way), open-concept floor space, colourful furniture and cube boards. Of course, not forgetting an aromatic welcome from the coffee machine at the entrance. These are the littlest things that make up the company's DNA today - innovative, forward-looking and vibrant. For students who want to embark on their tech startup, the office is truly impressive and inspirational.

Since pictures depict a thousand words, how about letting them speak for themselves? Scroll for more photos on the visit.

Visa's warm greetings for the students. What a happy start to the lab crawl series.

Visa's everyday operations, illustrated by a cube board.

Office goals. We could work all day at this common area.

Look at our NP students taking a ride on the Tuk Tuk with our Principal.

Live lessons on a Tuk Tuk: How to pay instantly to the driver, the cashless way!

End of tour!

___________________________

The year of the rooster signals new beginnings and fresh opportunities. On 1 February 2017, Lattice80's event space was turned into a dining and signing area for a Louhei and MOU signing ceremony between five polytechnics and the Singapore FinTech Association (SFA).

To say the turnout was good is an understatement. More than 100 mentors, industry partners and media guests gathered at Lattice80 to celebrate the festive season and get a glimpse of the partnership between the polytechnics and SFA that would entail a series of 100 lab crawls and workshops. If there is anything students and PolyFinTech mentors can look forward to, it is the wide range of visits, business challenges and workshops.

Chief FinTech Officer of the Monetary Authority of Singapore (MAS), Mr Sopnendu Mohanty and SFA's President, Mr Chia Hock Lai were there to give welcome speeches to share their vision on the collaboration. At the same time, our principal, Mr Clarence Ti, joined the dialogue and weighed in on the PolyFinTech100 initiative.

Pictured here are Mr Chia Hock Lai, Mr Sopnendu Mohanty, and principals from five polytechnics.

Crowd at Lattice80 for the Louhei and MOU Signing Ceremony.

Mr Sopnendu Mohanty giving his speech.

MOU inked between partners with their digital signatures. Talk about digital disruption.

Here’s to greater heights and better luck!

____________________________

Mr Sopnendu Mohanty is an expert with over 13 years of experience in the financial industry and the central bank. As the Head of the FinTech & Innovation Group (FTIG) with the Monetary Authority of Singapore (MAS), Mr Mohanty is also a pioneer leader in today's FinTech game. Students who want to venture into the FinTech industry can look forward to various opportunities. Internship placements are available to equip them with the necessary skills and experience to thrive in the global workplace. On top of that, they would be mentored by pioneering leaders of FinTech. Mr Mohanty is among them, and he shares his insights here.

Congratulations on your recent award, given by Asian Private Banker. As an expert who's well-versed in the financial industry , how do you think financial technology has changed over the years?

While technology is no stranger to the financial industry, the application of technology is increasingly becoming more pervasive. FinTech players are often coming up with faster, cheaper and easier ways to do things. In the past, financial institutions tended to develop monolithic solutions in stovepipes and it was difficult to integrate with external technology solutions. There was also strong resistance faced internally within the organisations and there was the notion that smaller start-ups did not have credibility.

Today, more financial institutions are noticing the benefits of FinTech. Some FinTech players can be very nimble, respond more quickly to changes and are not afraid to try out bold new ideas and solutions. Increasingly, we see our banks starting to open up their systems to integrate with the start-ups through Application Programme Interface (APIs). MAS' role is to facilitate such an open environment to spur more innovative financial services that will ultimately benefit consumers.

Recently, MAS had signed the Memorandum of Understanding (MOU) with the five polytechnics to nurture a pool of skilled manpower for the FinTech industry. What are the outcomes you hope to achieve out of this partnership?

We hope that the pipeline of graduating students will become more workforce-ready with a good understanding of FinTech and how technology can be leveraged effectively for better solutions and products. By working with the polytechnics in helping to review the existing curriculum, we shape the syllabus to be relevant for the current and future needs of the financial sector. Our students will graduate confidently with the skillsets they possess and apply in the real world.

By working on internships and projects with our FinTech partners, we hope that they will be able to develop an innovative mindset and entrepreneurial spirit, grounded by strong technical skillsets. We want our students to come out brave and dare to innovate, invent and be tech-savvy in our digital economy.

How do you think the FinTech internships will be of help to the students for their future career?

The internships will give the students a flavour of what it is like to work in a small, fast-paced FinTech environment. It will give them a better appreciation of the multiple facets of the FinTech business, and opportunities to solve real world problems in the financial industry. These internships will also help the students to network and meet the right mentors and contacts, to further their careers in this industry, and even inspire them as the next generation of innovators.

We noted that you are one of the mentors for the PolyFinTech 100 initiative. What advice would you give to the polytechnic students who are interested in the FinTech industry?

Do not be afraid of failures and stay hungry if you want to succeed. The FinTech & Innovation Group's motto at MAS is, "Dream big, start small, move fast."

Lastly, what are the emerging trends you see in the FinTech industry?

FinTech is transforming financial services in exceptional ways. The Internet and the prevalence of smartphones have enabled people to consume financial services on the go. We are also seeing emerging innovations in the spaces of digital payments and distributed ledgers. Catalysed by developments in digital identity and biometrics, digital payments have become increasingly pervasive. With the same fervour, the industry is experimenting with distributed ledgers in a gamut of financial service operations.

The most promising technology to reshape and transform financial services could lie in the field of big data analytics. Coupled with advancements in machine learning and cloud computing technologies, we have access to unprecedented intelligence and capacity with low entry barriers to aggregate and analyse huge data sets. Potential financial industry applications are virtually boundless across the financial service industry.

These are certainly exciting times ahead!

JOSHUA OW

JOSHUA OW

Could you share when the MAS-polytechnic Financial Technology collaboration was originally proposed?

This collaboration could best be read in the context of what’s happening in Singapore in this space. Many pieces were falling in place - Monetary Authority of Singapore (MAS) is setting up a dedicated FinTech Office with a regulatory Sandbox and Hackcelerator; the SkillsFuture movement with its emphasis on the mastery of skills; over 200 FinTech start-ups setting up in Singapore; banks going increasingly digital; and Singapore becoming an entrepreneurial hub. All these point to increased opportunities for exciting new careers, and opportunities to do some really fun and game-changing things.

A meeting was thus scheduled on April 2016 between Ngee Ann Polytechnic (NP), the SkillsFuture Sector co-ordinator for Accountancy and Financial Services, and MAS. The collaboration was an obvious one since the polytechnics have always played a key role in producing skilled manpower for industries.

How would NP students benefit from this collaboration?

The three biggest benefits are: opportunities, skills, and mentors.Our curriculum will be renewed to enable the building of emerging skills, technical, digital and entrepreneurial. Students from all polytechnics will have more opportunities to explore careers in FinTech, not only in banks and FinTech startups but also in the regulator MAS, venture capital firms, incubators, and accelerators, both locally and abroad, through internships, talks, and events. In 2017, we will curate 100 such internships available across all five polytechnics and will also have a community of 100 mentors to challenge and inspire the students.

Do you believe this collaboration will contribute to Singapore's quest to be a smart financial centre?

As William Gibson says, “The future is here already, it is just not evenly distributed yet.” Singapore, as a smart financial centre, will need a core of skilled persons of various disciplines coming together to build new customer experiences, build business models that can scale across geographies, reduce cost of operations, improve productivity, etc. From Singapore, we could also look at building solutions across the region, such as in areas of financial inclusion to combat poverty and inequality, gender empowerment and financial literacy, and also in tapping on opportunities arising for a rising middle class. Creating a PolyFinTech 100 platform through this collaboration is an expression of this effort.

ADAM IHSAN

ADAM IHSANAdam Ihsan is a year 2 student in Ngee Ann Polytechnic's School of Life Sciences and Chemical Technology. He is currently pursuing a Diploma in Biomedical Science. With a burning passion for all things technology and performing arts, Adam is also a Microsoft Student Partner.

Students, there has never been a more exciting time to join the FinTech industry.

Things have certainly changed in recent years. In my time as a student, there were opportunities for us when we were deciding on our internships. Now, the choices are limitless.

Our students today are fortunate. They have a myriad of new roles and career paths available to them. From entrepreneurship tracks, to interning at cities such as Silicon Valley, the exposure our 19-year-old kids get is invaluable.

That said, the majority of our students' career aspirations in the financial sector still mirrors the current state of the industry. In a banking world, the business and IT functions within banks tend to operate in well-defined scopes. Technology teams are generally regarded as supporting arms or shared services across different business lines, such as consumer loans, credit cards and mortgage financing. For many of them, they simply envision themselves as a banker or a technologist.

While many of them prefer sticking to the conventional route for their internships, there is an increasing number of students who are highly enterprising. Ambitious even. They have various interests, skillsets and confidence. They know these enable them to be well-placed to meet the increasing demand for talent in multi-faceted roles.

One such emerging sector which requires such talent is the FinTech industry. I am talking about the revolution that has got everyone sitting up and noticing.

FINTECH

For a long time, FinTech has been a buzzword that piqued the interest of investors and the media. When top executives in traditional banking jobs leave to join Fintech start-ups, you know something big is brewing.

What then, is the reason for its rapid rise to success? FinTech start-ups identified a shift in society, led by a consumer demand for innovative and digital services. It is easy to see why FinTech is able to carve out a niche to differentiate itself from traditional banks. Things need to be easier, more accessible and instantaneous.

Yes, you get the hint – everything has to be fast and convenient. The originators of FinTech recognised this expectation and put a spin on our financial services.

The good news? We are no longer restricted to traditional ways of doing our banking.

A New World of Possibilites

Never has it been easier to connect students and mentors, and this reality was made possible because of a recent Memorandum of Understanding (MOU) signed between the Monetary Authority of Singapore (MAS) and the five polytechnics on 3 October.

The MOU between MAS and the polytechnics marked a new direction towards FinTech with the use of technology to enable efficiency for financial services.

Alongside MAS, they will review their curriculum and facilitate internships for final-year students at Fintech start-ups, financial institutions and regulatory bodies.

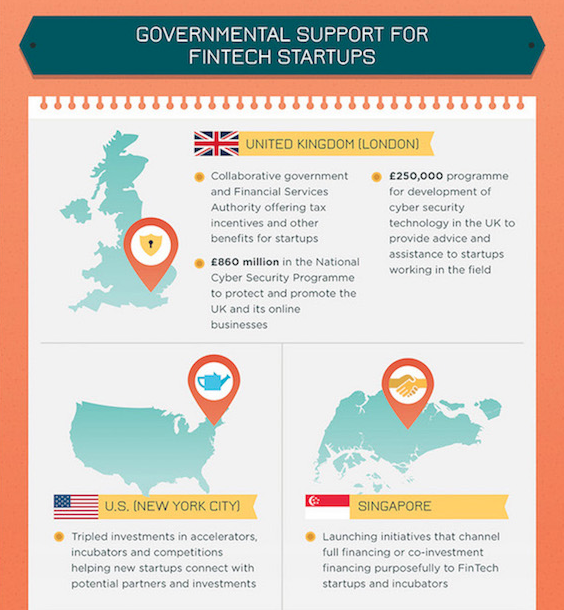

With governments around the world pulling out all stops to show support for FinTech, maybe now is the time for people to sit up and take notice of this tech revolution.

For this full infographic on FinTech, check it out at

Everything about Fintech

More on PolyFintech 100 collaboration and how to become a FinTech mentor at http://www.polyfintech100.sg/

ENG HUI SHAN

ENG HUI SHAN

Last updated: Tuesday, 28 March 2023